It’s amazing that more than 300 people have subscribed to the Future of Finance Premium newsletter over the late summer. A warm welcome to those of you receiving it in your inbox for the first time, and thanks to the subscribers who have already been with us for the past few posts!

Don’t miss this: Nearly 20 exclusive live blog posts from the DNB Digital Asset Summit are now embedded directly from our LinkedIn feed. Whether you attended or not, catch all the essential insights, updates, and highlights in one convenient place — right here in the newsletter.

At Kaupr, we’ve been busy attending conferences and meetups across Oslo, Helsinki, Stockholm, and Copenhagen. As we head into an even more exciting autumn, we want to share a summary of the latest news, interviews, and highlights to keep you informed.

Here’s what else you can expect in this edition:

Exclusive video interviews with business leaders including Erald Ghoos (OKX), Thuc Hoang (Firi), and Ole Morten Sunde & Nikolay Nyrud Gobel (DNB)

Recent and relevant Nordic and global news

Snapshots from community events in Oslo and Copenhagen

For those already following the breaking news on Euro stablecoins, for instance on our active Linkedin page, stay tuned — we’ll cover this topic in depth in the next newsletter.

Exclusive video interviews by Kaupr

On a regular basis, Kaupr and its editor, Morten Myrstad, conduct video interviews with business and thought leaders in crypto and digital assets, in the Nordics and beyond.

Below we share a short intro and links to some of the latest business leader talks.

Erald Ghoos, CEO OKX Europe

OKX is among the first global exchanges to seize new MiCA opportunities. In an exclusive interview, OKX Europe CEO Erald Ghoos explains how the firm is targeting the European and Nordic markets, combining global strength with local presence.

Based on the size of the economies, OKX’s key markets in Europe are Germany, France, Italy, Spain, and Poland. But according to Ghoos, the Nordics are quickly following suit. “Based on user interests, GDP, and education, the Nordics are extremely interesting markets for us,” he says.

Ole Morten Sunde and Nikolai Nyrud Gobel, DNB

The Digital Asset Summit by DNB in September marks a new step in the digital asset journey of DNB. DNB has an “iterative” roadmap and is piloting on an internal tech platform, but is not ready to kick the launch button on any products as of now.

In a 40‑minute interview, Kaupr spoke with two members of DNB’s digital asset core team, Ole Morten Sunde and Nikolai Gobel. The discussion covered global, European and Nordic trends, and developments in technology, finance and regulation. Specific product areas such as custody, stablecoins, CBDCs, tokenization of securities, ETPs/ETFs and crypto trading were also addressed.

The Norwegian company Firi today stands out as the clear market leader among the Nordic crypto exchanges, with a strong base of active customers, impressive trading volume, and solid profits. But can Firi maintain its lead?

At Kaupr, we have spoken with Thuc Hoang, the CEO of Firi, about the key drivers behind the company's success and its plans for the future. Firi is now expanding beyond Norway and Denmark, looking to grow its presence across the Nordics and throughout Europe, while also targeting institutional investors, as well as offering new products and services for retail investors.

Nordic news from kaupr.io

Swedish Bitcoin Treasury Capital AB launches a new share class with a direct exposure to bitcoin, monthly dividends and priority in the event of liquidation. The new stock class may come to attract a new breed of Bitcoin treasury investors.

“Finally!” This was the happy message on X from Alexander Hagen, CEO of Ace Digital, just before the weekend. The explanation for Hagen's happy announcement was that the company could now announce that the Ace Digital stock will be listed on Euronext Growth Oslo on September 25..

Klein Group is discontinuing the Aurora3 brand and consolidating its investment in Web3 and the blockchain into Klein Group AS, integrated with AI & Technology, iGaming and Commerce. At the same time, Andre H. Johnsen, joins the role of General Manager of crypto lending company Norlend AS.

Bitcoin is no longer just digital gold. The Norwegian company Norlend, led by Andre Johnsen and eidd of K33, is now going out and offering infrastructure and technology for businesses looking to offer loans secured by Bitcoin.

Global news from kaupr.io

Tether is expanding its foothold in the US with the launch of a new US-specific stablecoin called USAT, designed to comply with evolving US regulations. This move marks a significant shift for the stablecoin giant.

Gemini's crypto exchange soared nearly 32% in its IPO debut, valuing the company at around $4.4 billion after trading started. Gemini began trading under the ticker GEMI on Nasdaq after pricing the IPO at $28 per share and bringing in $425 million.

Fireblocks launches Network for Payments, a global infrastructure that enables institutions to process payments based on stablecoins across blockchains and traditional payment systems.

Strategy, formerly MicroStrategy, was not admitted to the S&P 500 despite the company meeting the criteria for inclusion. Robinhood instead took an unexpected spot, sending Strategy shares lower while Robinhood surged.

Live blog posts from DNB Digital Asset Summit

DNB, Norway's largest bank, was taking the discussions about cryptocurrency and digital assets into the public eye. On 19 September, the bank hosted the Digital Asset Summit in Oslo to identify opportunities in what could be the next chapter of the financial industry.

The Kaupr Team was there, with a team of four, connecting, taking notes, took photos and videos, and live blogged during the event.

Below you can scroll through our live blogs, and revive the content, or get some fresh content if you were not at the summit.

Today at the Digital Asset Summit by DNB

Alexander Opstad, DNB: Setting the stage

Ole Morten Sunde, DNB: Tokenization explained

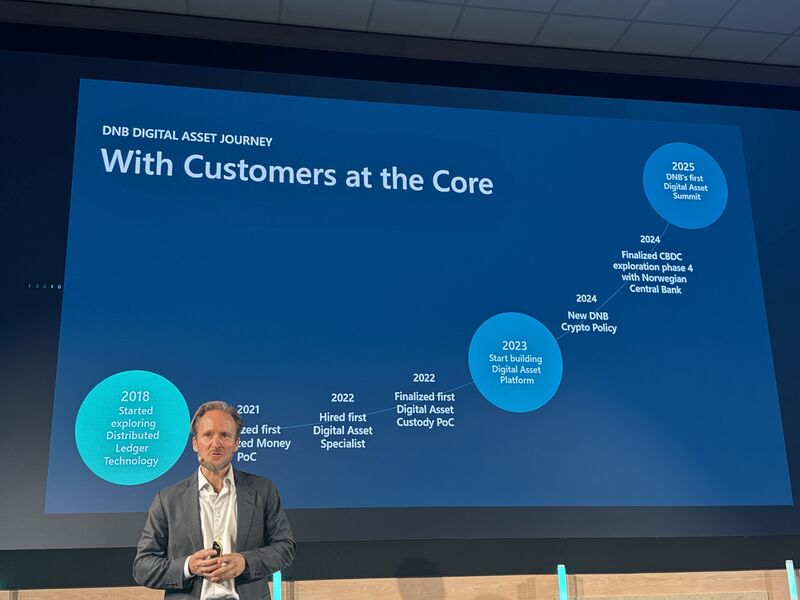

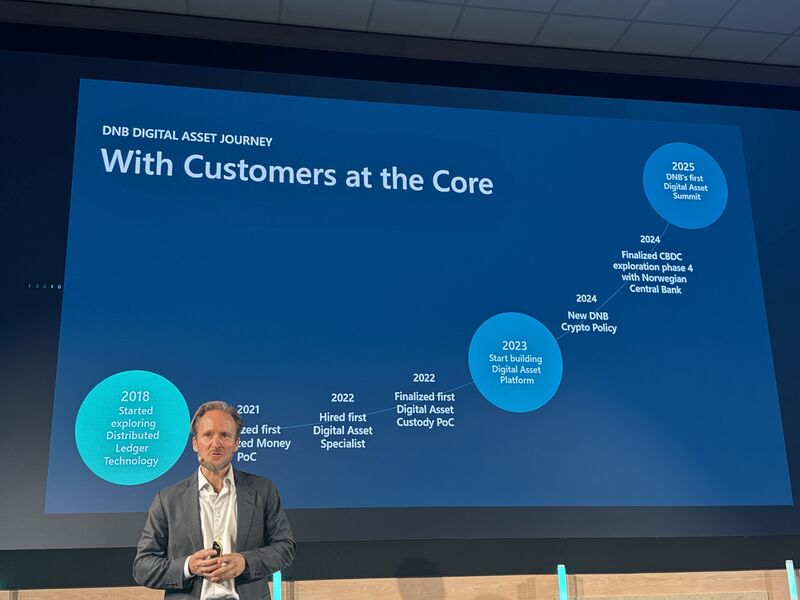

Ole Morten Sunde, SVP and Head of Emerging Business Products at DNB, opened today’s Digital Asset Summit with a clear message:

“Tokenization can make financial services faster, cheaper, and more… | Kaupr

Ole Morten Sunde, SVP and Head of Emerging Business Products at DNB, opened today’s Digital Asset Summit with a clear message:

“Tokenization can make financial services faster, cheaper, and more accessible.”

Highlights from his keynote:

Tokenization explained; turning assets (property, securities, commodities) into tokens on-chain, enabling 24/7 instant settlement across money and assets.

Why it matters; more efficient money management, new use cases for collateral, and broader accessibility.

Tokenized money; from CBDCs to tokenized bank deposits and stablecoins. These are no longer experiments, but questions of power and control in the financial system.

Challenges to solve:

•Cross-border regulation harmonization.

• Interoperability between blockchains and traditional finance.

• DNB’s vision: customers want safe custody, frictionless services, and bridges between digital assets and traditional finance.

• Building a digital asset platform as the foundation for a tokenized future.

👉 Ole reminded the audience that DNB began this journey in 2018, step by step, and today the bank is ready to move forward at the right pace together with customers, regulators, banks, fintechs, and partners.

www.linkedin.com/feed/update/urn:li:activity:7374744144453378048

Dovile Silenskyte, WisomTree: Crypto can no longer be ignored

Dovile Silenskyte, WisdomTree: Holding zero isn’t neutral

Torbjørn Bull Jenssen, K33: Has Bitcoin been tamed or are banks riding the Trojan horse?

#digitalassets #bitcoin #kaupr #blockchain #finance #nordics | Kaupr

“Has Bitcoin been tamed or are banks riding the Trojan horse?”

At the Digital Asset Summit, Torbjørn Bull Jenssen (CEO & Founder, K33) reflected on Bitcoin’s journey from a peer to peer cash system outside banking, to being embraced by financial institutions: Bitcoin will change finance more than finance changes Bitcoin.

Its three unique features:

Selfsovereign money, no counterparty risk, borderless, resilient in crises.

Crossborder utility: already used in real world cases like Ukraine when banking systems failed.

Absolute scarcity: only 21 million Bitcoin will ever exist, making it highly attractive in a world of debt and inflation.

In the Nordics, 1 in 5 under 40 already own crypto, with adoption accelerating across all ages.

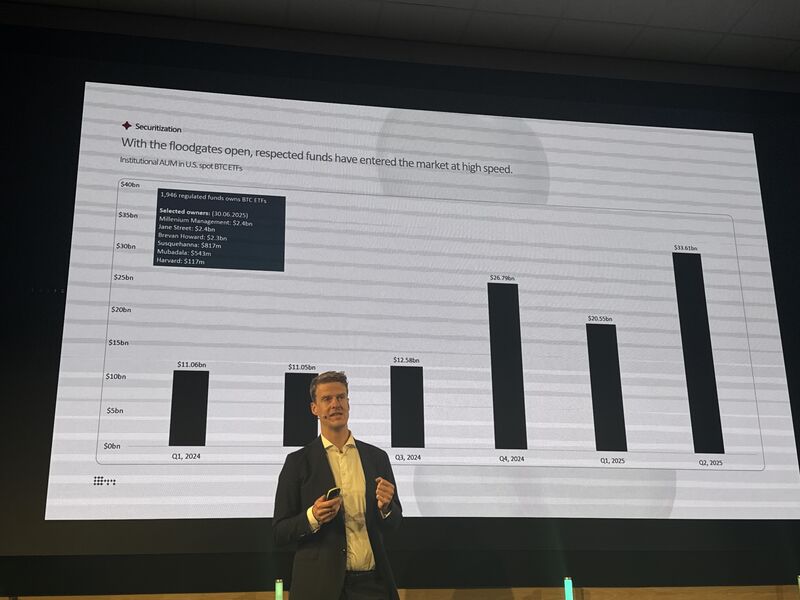

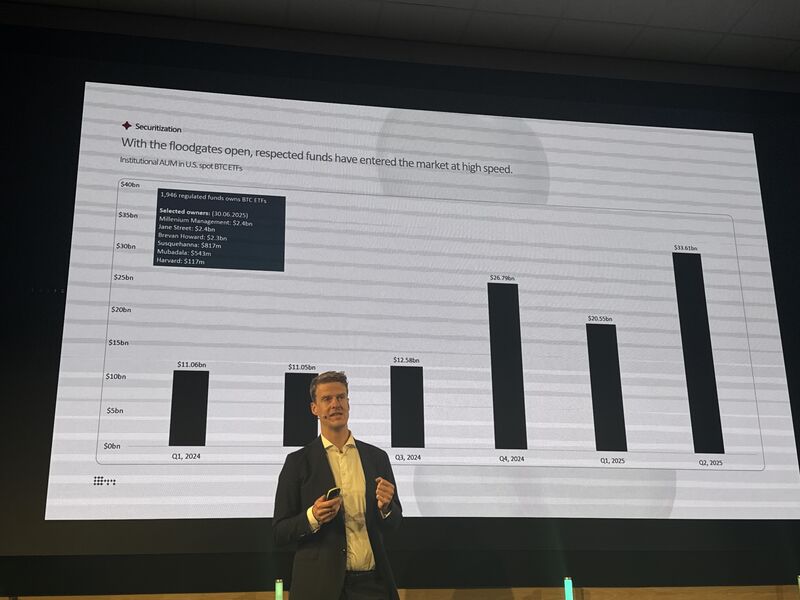

Institutional adoption is rising fast. ETFs and ETPs are breaking records, with investors from retail to sovereign wealth funds.

Torbjørn Bull Jenssen’s key point: Bitcoin is no longer fringe it’s mainstream, and it’s only the beginning of how finance will adapt.

#DigitalAssets #Bitcoin #KAUPR #Blockchain #Finance #Nordics

www.linkedin.com/feed/update/urn:li:activity:7374752064280752128

Nikolai Nyrud Gobel, DNB: Crypto is no longer niche. Its mainstream.

Nikolai Nyrud Gobel, DNB: The generational shift in investing

#digitalassets #crypto #dnb #investing #generationalshift | Kaupr

The generational shift in investing is clear.

At the Digital Asset Summit, Nikolai Nyrud Gobel, Product Manager Digital Assets at DNB, shared striking data:

Among DNB clients aged 18–40, 165,000 own crypto, 107,000 own stocks

Among clients 40+, crypto adoption more than doubled in one year, from 47,500 in 2024 to 110,000 in 2025

Internationally, wealthy Americans aged 21–43 allocate 17% of their portfolios to crypto, compared to just 1% for those 44+

The takeaway, digital assets are no longer a fringe interest, they are becoming a core part of diversified portfolios, led by younger investors but rapidly spreading across generations.

#DigitalAssets #Crypto #DNB #Investing #GenerationalShift

www.linkedin.com/feed/update/urn:li:activity:7374758071111213056

Nikolai Nyrud Gobel, DNB: From vision to prototype

Panel: From rebellious money to an institutional asset class?

#digitalassets #crypto #bitcoin #finance #tokenization #dnb | Kaupr

From rebellious money to an institutional asset class?

That was the core question debated at the Digital Asset Summit panel featuring:

Morten Søberg, PhD, Secretary General, Bitcoin Policy Institute Norway

Nikolai Nyrud Gobel, Product Manager Digital Assets, DNB

Torbjørn Bull Jenssen, CEO, K33

Dovile Silenskyte, CFA, Director of Digital Assets Research, WisdomTree

The discussion highlighted:

Bitcoin’s transition from a peer-to-peer alternative to a mainstream, institutionalized asset.

Growing demand for regulated, secure investment products like ETFs and ETPs.

The generational shift in adoption with younger investors leading, but older demographics catching up fast.

The role of banks, asset managers, and fintechs in shaping this new market structure.

The takeaway: crypto is no longer just a question of innovation, but of institutional trust, infrastructure, and strategy.

#DigitalAssets #Crypto #Bitcoin #Finance #Tokenization #DNB

www.linkedin.com/feed/update/urn:li:activity:7374770637891989504

Ville Sontu, Nordea: Why do we need digital currencies?

Ville Sontu, Nordea: Future of Money

Norges Bank: Preparing for a potential CBDC

Norges Bank: Retail & Wholesale CBDCs

Erik Almedal, DNB: CBDCs and Tokenized Finance

Erik Almedal, DNB: Testing Tokenized Money

Varun Paul, Fireblocks

#digitalassets #cbdc #stablecoins #tokenization #innovation #finance | Kaupr

Stablecoins, Tokenized Deposits, CBDCs what’s the difference?

At the DNB Digital Asset Summit, Varun Paul (Fireblocks, ex-Bank of England) broke it down with clear definitions:

Stablecoins: issued by anyone, backed by reserves, freely tradable on exchanges.

Tokenized Deposits: issued by commercial banks, regulated, claims on the bank, easily convertible into deposits.

CBDCs: issued by central banks, enshrined in law, ultimate claim on the government.

This framing highlights how digital money is evolving, from decentralized innovation to regulated banking rails and sovereign money.

The key question: which model will dominate, and how will they coexist?

#DigitalAssets #CBDC #Stablecoins #Tokenization #Innovation #Finance

www.linkedin.com/feed/update/urn:li:activity:7374781398961946624

Nadine Teychenne, Citi

Getting together at community events in the Nordics

DNB Digital Asset Summit, Oslo, September 19, 2025

From last week’s DNB Digital Asset Summit: was it a “we were there” moment in the history of bitcoin, crypto, and digital assets in Norway? Perhaps.

It was surely a WE moment — as people from across… | Kaupr

From last week’s DNB Digital Asset Summit: was it a “we were there” moment in the history of bitcoin, crypto, and digital assets in Norway? Perhaps.

It was surely a WE moment — as people from across the Norwegian community, and from both traditional finance and crypto, gathered at DNB’s first Digital Asset Summit to reflect on how far the integration between the two has come, and to look ahead at what’s next.

To preserve that shared feeling, we skip company names and simply list the people captured in a few snapshots taken during the breaks.

From left to right in each image:

Image 1: Torstein Thinn, Kaja Vagle, Torbjørn Bull Jenssen, Venkat Hrushikesa Varri & Marius Javier Moreno-Sandnes

Image 2: Andre H Johnsen and Magnus Jones

Image 3: Ida Hvitsand and Martin Heggen Strønstad

Image 4: Jan Rasmus Platou, Johanne Andresen, Arild Fernandez Møller-Holst, and Jon-Marius Omberg

Image 5: Ken-Erik Ølmheim, Sophia Adampour, and Bjorn Kienholz Bjercke

Image 6: Ole Morten Sunde and Nikolai Nyrud Gobel

The Kaupr team at the event: Leon Aleksander Karlsen Solbakken, Morten Brun, Venkat Hrushikesa Varri and Morten Myrstad

www.linkedin.com/feed/update/urn:li:activity:7375916752158834688

NBA event, Copenhagen, September 2025

Oslo Blockchain Meetup, Oslo, September 2025

The “Digital Money” scene in Oslo last week brought a mix of events, each with distinct topics and audiences. Last Wednesday, the Oslo Blockchain Meetup drew a record turnout of around 50… | Kaupr

The “Digital Money” scene in Oslo last week brought a mix of events, each with distinct topics and audiences. Last Wednesday, the Oslo Blockchain Meetup drew a record turnout of around 50 participants for two tech talks, covering Bitcoin Cash and Bitcoin Ordinals.

Large image: Lars Erik “Tiny Vikings” (left) and Halvor Bakke-Veiby in front of the audience.

Image right top: Halvor Bakke-Veiby presenting Cauldron DEX and Moria USD.

Image left under: Lars Erik “Tiny Vikings” during his presentation on Bitcoin Ordinals.

After sharing his perspectives on the meaning of money, Halvor Bakke-Veiby of Riften Labs introduced the audience to Cauldron DEX, which he described as the world’s fastest decentralized exchange. He also presented Moria USD Ⓜ️ (MUSD), a decentralized finance (DeFi) protocol built on Bitcoin Cash that enables users to mint the stablecoin MUSD by locking BCH as collateral.

Lars Erik, Tiny Vikings, also took the stage to discuss how developers can build software and applications using Bitcoin Ordinals. Presenting the project Open Ordinal, he explained its goal of simplifying development with Ordinals to support a next-generation internet on Bitcoin. His talk included practical examples from gaming, lottery chat, and social media.

The event was organized by Magnus S. Espeland in Oslo Blockchain Meetup and supported by Kaupr and Moria Money.

Join the Oslo Blockchain Meetup group to be notified of future meetups:

https://lnkd.in/dzkdUPP6

www.linkedin.com/feed/update/urn:li:activity:7375890645984501760

Thanks for following along!

Thanks again for reading the Future of Finance Premium newsletter! We’d love to hear your feedback and any suggestions for topics you’d like us to cover next. And don’t forget to subscribe so you never miss an update!